Urban local bodies (ULBs) – Municipal corporations, councils and parishads directly deal with the local production and provide basic services such as water supply, sewage, street lights, garbage collection, etc. To provide these services ULBs mainly rely on grants from State Governments.

There is a rapid increase in the urban population and this puts extra burden on already not so well financed urban local bodies. Hence, it is prudent to look at ways to improve the revenue generation at ULBs.

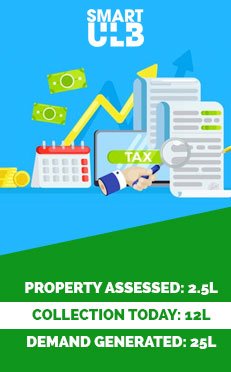

Property Tax is the principal source of revenue for Urban Local Bodies in virtually every part of the world. In most cities in India the property tax base has been considerably eroded by administrative and procedural inadequacies.

.. As per AMRUT guidelines, ULBs shall have 90% coverage with 90% collection

In most of the ULBs, a significant number of properties are not included in the tax base; those that are included are inaccurately assessed and hence the collection of property tax is inefficient.

We believe – an integrated, robust, cost effective and Easy to use ERP such as SmartULB that is designed keeping the needs and demand of citizens at centre could bring in operational efficiency that contributes to strengthening of ULB’s financial base.

Refer our Revenue Augmentation model on how we could help you increase revenue by as much as 300% (link to service module – > Revenue Augmentation)

SmartULB is a suite of web and mobile based applications that are developed keeping the needs of both citizens and ULBs at the centre. With its easy to use and self-guiding workflows it is easy for citizens and employees to adapt quickly. Some of the features are:

- Property Assessment

- Property Self-Assessment

- Verification

- Demand Generation

- Payment History

- Pay Now (credit cards, debit cards, wallet, etc.)

- L-Ledger, K-Ledger

- Demand-Collection-Balance

- Web and Mobile Interface

- Property Search by ward, zones, etc.

- Request for Door Step Payment

- Integration with user charges features (for e.g. water charges)