With rapid increase in urbanisation, it is important to transform the services which are being delivered to citizens through Urban Local Bodies (ULBs), viz. Municipal Corporation, Councils and parishads.

To maintain and significantly improve the quality of services, it prudent to explore ways to enhance their own revenue.

evenue generation is one of the critical functions of ULBs to increase the efficiency in basic services provided to the citizens. Property Tax is the principal source of revenue for Urban Local Bodies in virtually every part of the world. In most cities in India the property tax base has been considerably eroded by administrative and procedural inadequacies.

Revenue is not realized fully in most of the ULBs, as significant number of properties are not included in the tax base; those that are included are inaccurately assessed and hence the collection of property tax is inefficient.

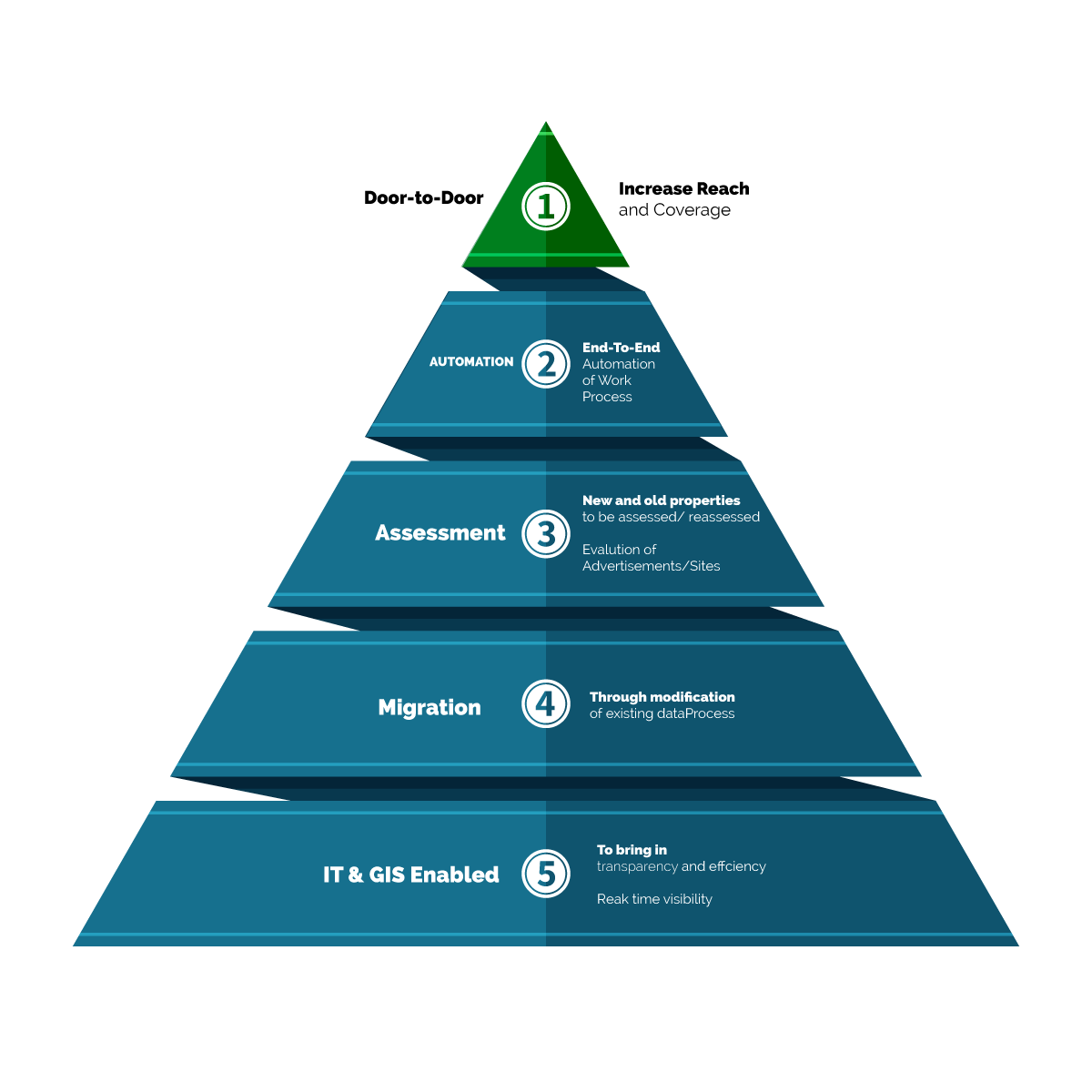

We have proven methodology to include every house-hold into the tax base along with proper touch base (door to door) for quarterly and annual collection of taxes, fee and utility/user charges and to have an interface for MIS and data analysis. This not only significantly increase the revenue for ULBs but also reduces the operational and capital expenses of the ULBs.

- Bring every house-hold into tax base

- Door to Door Service

- Integrated modules for Survey, Assessment, Collection and Recovery of Property Taxes and other usage charges

- Property Verification

- Demand Generation

- Payment History

- Pay Now (credit cards, debit cards, wallet, etc.)

- L-Ledger, K-Ledger

- Demand-Collection-Balance

- Web and Mobile Interface

- Grievance Redressal System

Public Private Model on Revenue Sharing.

Easy Approval and Low Risk

Low gestation period, with revenue generation in less than 3 months.

Implementation of rules and regulations as per latest Municipal Acts

Implementation of new notifications / rates of tax or non-tax fee and charges

Ease of Living and Doing Business